How does it work?

EU Registered Companies

If your company is registered within the EU, enter your company name and TAX code (including prefix), proceed, and the TAX will be deducted from your order.

UK Registered Companies

If your company is registered within the UK, you will still be liable to pay TAX on the purchase price of what has been bought, but you can claim the TAX back from your tax return at the end of the financial year.

How can I apply my TAX Code to my order?

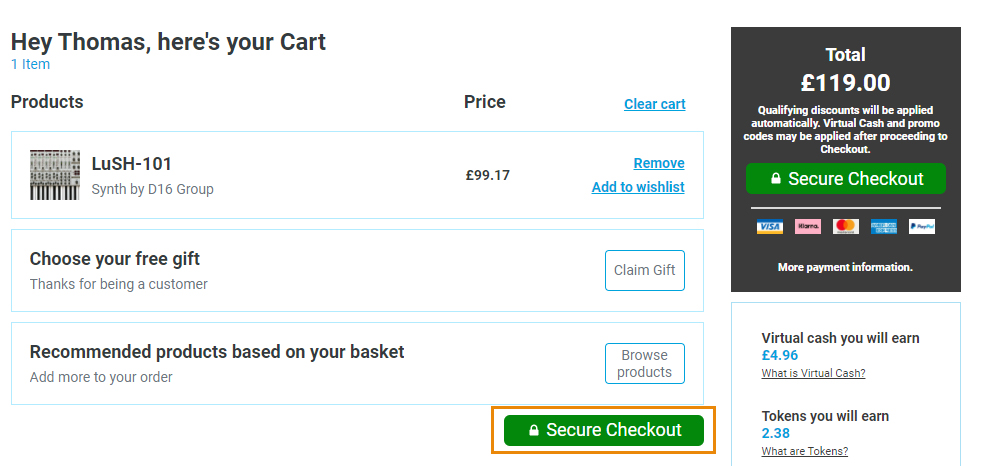

1. Once a product has been added to your CART area, click the 'Secure Checkout' option.

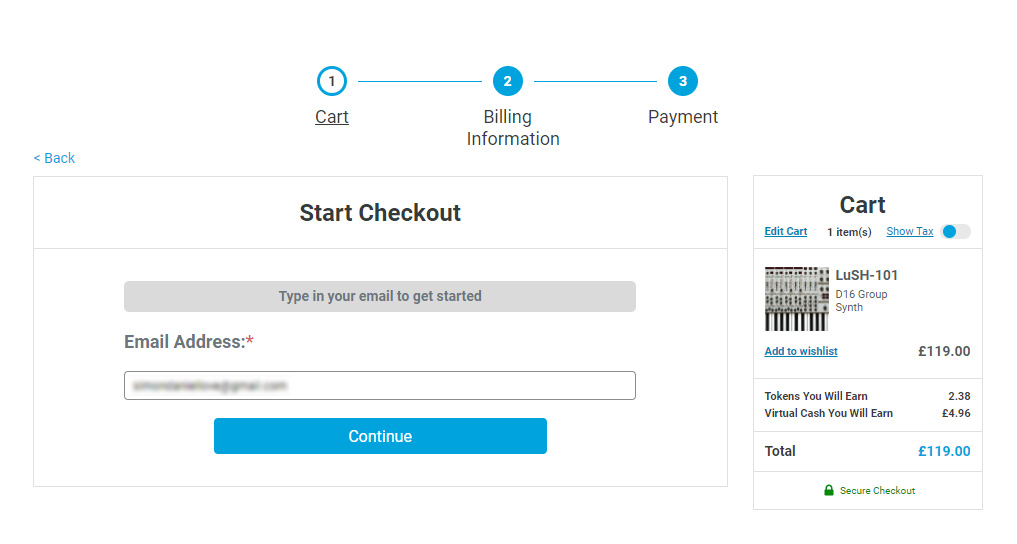

2. Type in your email to get started > then click Continue.

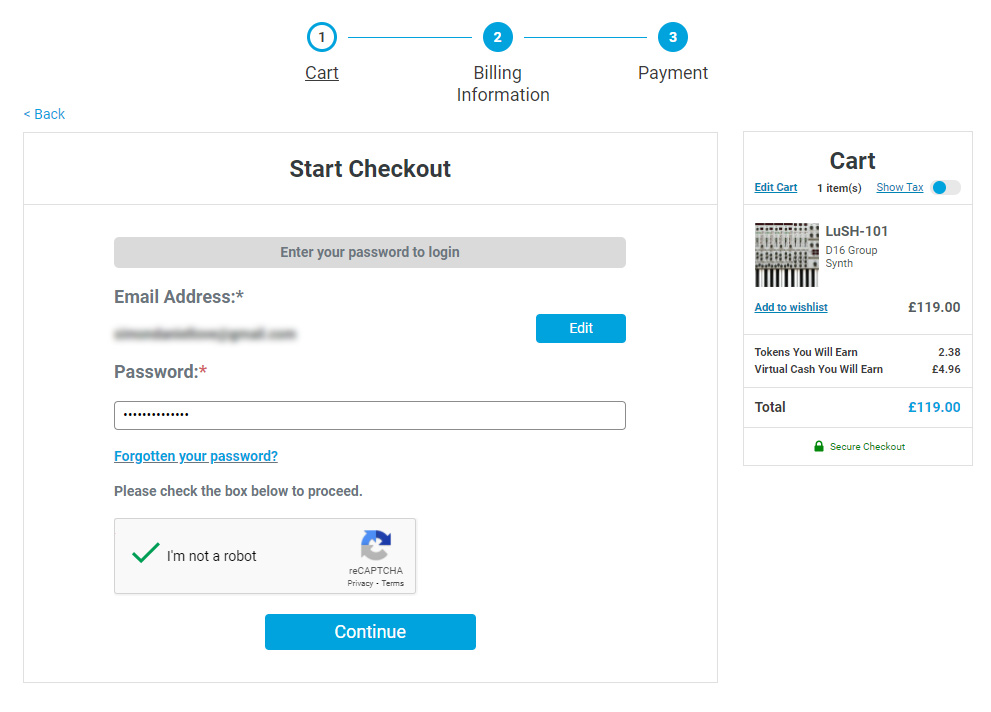

3. If you have an account with us already, log in by entering your password > Click 'I'm not a robot' and then Continue.

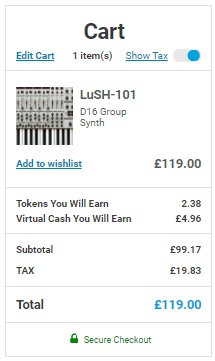

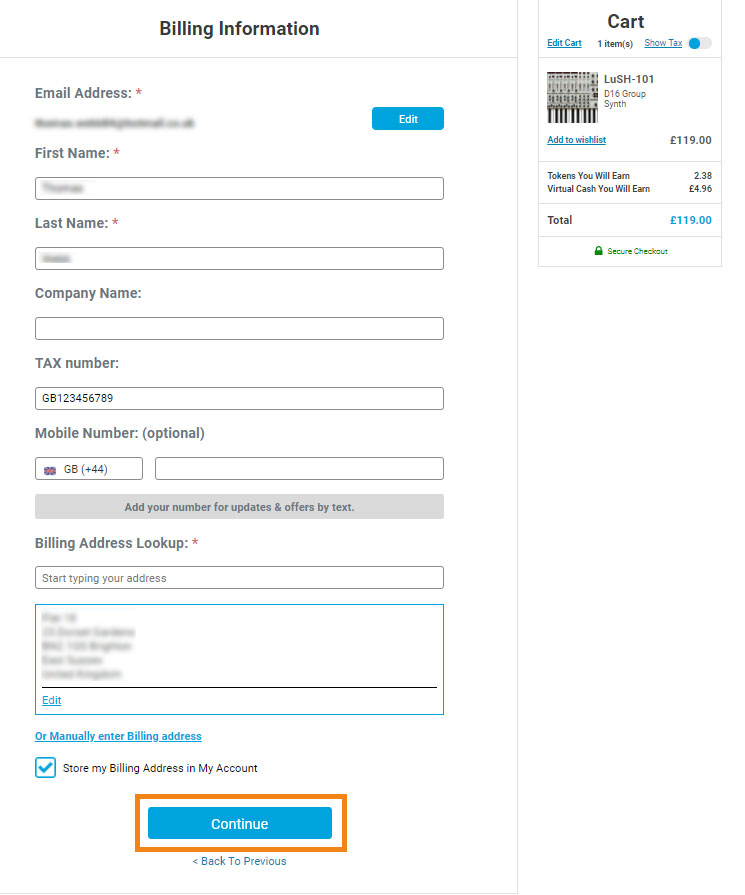

Tip: you can view a breakdown of the tax (if applicable) by clicking Show Tax:

4. If you do not have an account, one will be created for you during the checkout process. Enter your Billing Address information and TAX number.

Please note: make sure to include your country prefix/code before your TAX code with no spaces.

For Example: GB123456789 instead of GB123 4567 89

I have entered a valid TAX code, but the VAT amount hasn't been deducted?

Our system is connected to the European Union’s VIES VAT validation system in order for us to be certain that the VAT number/TAX code you have provided exists.

On some occasions, this system may return with an error stating your VAT number is not valid, thus not allowing you to proceed with your order. If this issue occurs, we recommend that you delay completing your order and try again shortly afterwards.

The validation of VAT/TAX codes can also be checked HERE.